Concorde Staff

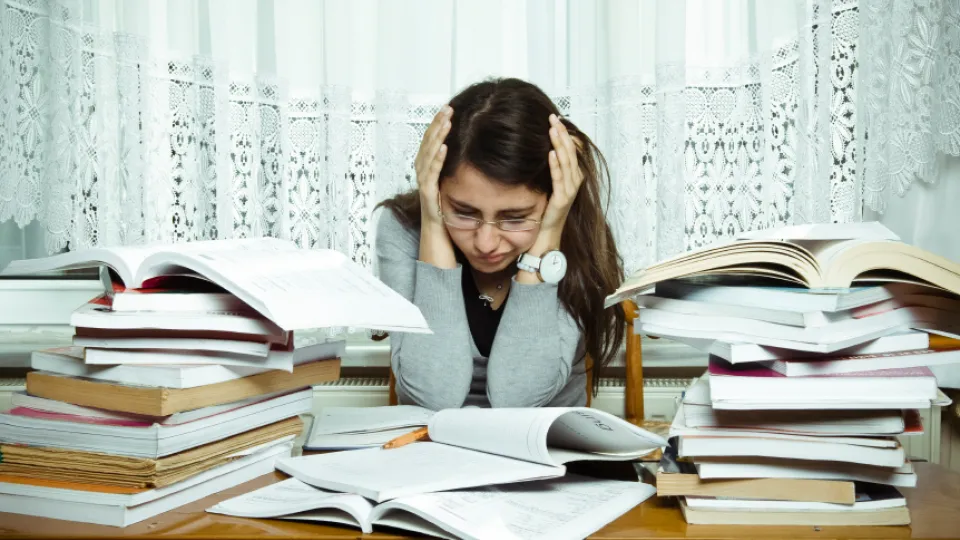

While college life is romanticized by many, the truth is that many students are overworked and stressed out. Add in the fact that college students live like paupers and it is easy to see why many develop poor eating and spending habits. This can lead to sickness, depression and even a mental or physical breakdown. Let's take a look at a few tips that will help you manage your finances, stress, and health successfully.

A DIVERSE DIET

College students tend to eat the same quick, easily made foods over and over again. Don't fall into this trap. Nutritionists across the globe agree that the human body requires a diverse array of foods to function with optimal efficiency. You'll feel much healthier and happier if you eat plenty of fresh vegetables and fruits. Incorporate a mixture of colorful foods with a particular focus on those that contain vitamin C. Grapefruits, oranges and other citrus fruits will boost your immune system and help you cope with stress.

DON'T ACCUMULATE SLEEP DEBT

While many college students have to take out loans to get a degree, building up sleep debt is unnecessary. There is little point in being awake if you are constantly tired. Avoid the temptation to skimp on sleep and you'll find that you feel considerably better. Sleep boosts your immune system, increases productivity and reduces stress.

STEP AWAY FROM THE SCREEN

Nowadays, just about everyone spends a percentage of the day staring into screens. Whether it is the computer, TV or smartphone, it seems impossible to get away from the screen. Screens emit positive ions that some researchers say cause depression and stress. Unplug from your electronic devices and take a step outside. See if you don't notice the improvement some fresh air brings to your well-being.

BUILD CREDIT BUT DON'T ABUSE IT

Your college years serve as an excellent opportunity to build your credit. Most college students have at least one credit card and understand just how important a good credit rating is to future endeavors. Once you graduate, you'll want to land a job, lease an apartment and obtain financing for a vehicle. Stick to a credit card with a low limit so that you are not tempted to amass a considerable amount of debt during your college years.

ESTABLISH AND ADHERE TO BUDGET

Creating a budget is something that anyone can do. Remaining loyal to its limits is the challenge. Write down all of your monthly income sources and monthly expenses. While it is difficult to pinpoint expenses before they pop up, you should budget in a certain amount of money each month for the unknown. Once you have a rough draft of your budget, make a wholehearted attempt to stick to it for a month. Track your expenses and tinker with your budget across posterity. Don't hesitate to rely on personal finance management tools available on the web to help you build, refine and stick to a realistic budget.

LEARN TO DISTINGUISH BETWEEN WANTS AND NEEDS

If you budget $50 a month for a "want" like video games, you might regret it. Identify all of your "needs" and then make a list of your desires. You might be surprised at the little bit of money that is left to pursue those desires. Consider setting aside a monthly or weekly allowance for entertainment spending. If you run out of money, force yourself to wait until your next allowance period to spend on those luxury items.

These are but a few ways to get your stress and finance triggers under control. The trick is to find the tips and resources that work for you. With distractions firmly under control - and your health on track - your role as a student can be rightfully front and center. Good luck!

Take The Next Step Towards a Brighter Future

We have a Concorde representative ready to talk about what matters most to you. Get answers about start dates, curriculum, financial aid, scholarships and more!